WeGoLook — Crawford’s on-demand workforce of Lookers who visit sites to gather and validate information so that clients don’t have to — has already changed the game when it comes to claim validation but is now revolutionizing pre-loss risk assessment too.

WeGoLook launched in 2009 to help online buyers inspect the quality of prospective purchases before they buy. However, it quickly became apparent the service could have game-changing applications in the field of insurance claims and Crawford purchased the company in 2017.

The WeGoLook network, which has grown to 46,000 Lookers worldwide with 1,500 in the UK, puts stakeholders’ eyes on losses more quickly and more cost-effectively than in the past. A great example of this is the deployment of thousands of Lookers in the wake of recent hurricanes in the U.S.

Our solution has now extended into the pre-loss space, with Lookers helping insurers and risk managers better understand their exposures at specific locations, aiding decision-making and risk mitigation efforts while reducing the likelihood of future claims.

Lookers can, for example, check that insureds have the level of physical security or health and safety signage that they claim, giving underwriters comfort that they are writing the right risks at the right price. This frees up resources to focus on more complex and higher value risk assessments.

Similarly, risk managers for organizations with large geographical footprints such as retailers, constructors, property managers, distributors or logistics firms can use Lookers to conduct regular site inspections on their behalf to ensure risk management and brand standards are being met.

Often corporations will not have the time or resources to justify the expense of regular basic inspections, particularly on low value risks. Tools such as Google Maps can provide helpful visual information but can quickly become out of date.

But much like sending a mystery shopper to assess the front-end of a retail operation, WeGoLook allows users to quickly and cost-effectively conduct general or specific checks across a range of property types and risks, both domestic and commercial.

Crawford invests heavily in vetting, screening, engaging and training Lookers so that they know what to look for on-site and are trusted ambassadors of the Crawford brand. Lookers are trained in specific protocols across a wide array of perils, from subsidence and escape of water to fire, theft, public liability and beyond.

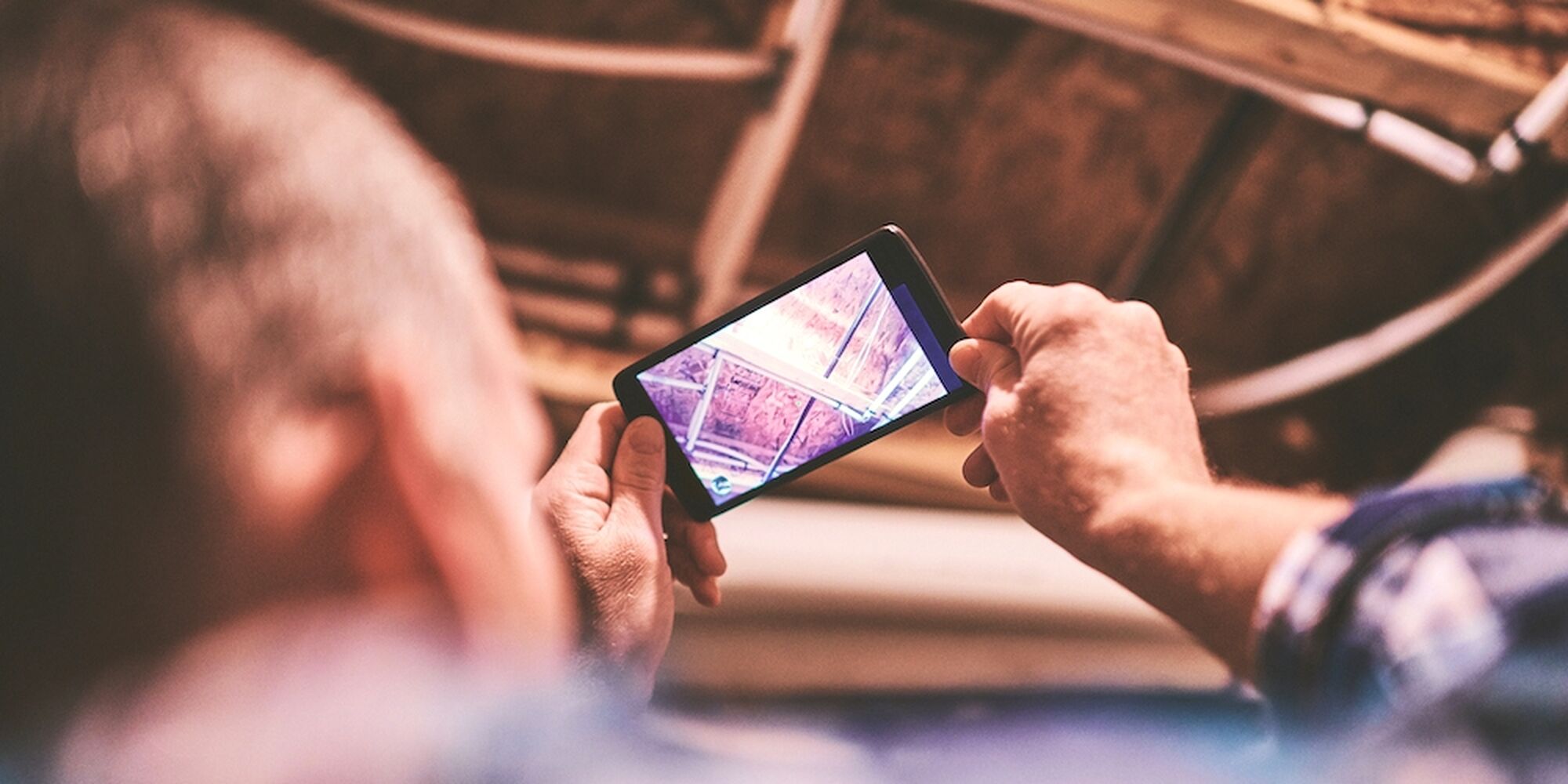

Crawford has also developed a self-service option called YouGoLook — available in the UK — which allows insureds to validate low value claims themselves via their smartphones. This tool has pre-loss applications, allowing risk managers to receive regular updates from branch or site managers without leaving their places of work, or to send evidence of risk mitigation efforts to insurers.

Both WeGoLook and YouGoLook give risk managers and insurers a constantly-updated visual timeline through which to track the improvement or deterioration of conditions at any given location without the need for site visits, saving time and money and ultimately improving risk.